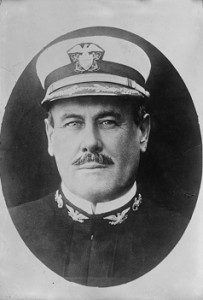

William J. Maxwell Executive General Order Nos. 180 – 194

Executive General Orders issued by Naval Governor William John Maxwell (28 March 1914 – 29 April 1916). To learn more read his entry, Governor Maxwell. To go back to the list of General Orders click here.

No. 180

22 April 1914

Executive General Order No. 180

1. All merchants, persons, corporations and agencies engaged in trade in this Island shall keep the books required by the Commercial Code in force in the form required by Law and said books shall be kept in the English language.

2. (a) Beginning June 1, 1914, and in addition to licenses now required, a tax of two and one-half percent upon the total sales of liquors and alcoholic beverages for each calendar month of each year will be paid into the Island Treasury by all clubs, agencies, associations, hotels, restaurants, cafes and other engaged in the sale of liquor and alcoholic beverages.

Business houses or agencies or shops established, incorporated and doing business solely for support of public utilities or of charitable institutions are exempt from this tax.

(b) This tax shall be levied but rebated on all beverages containing alcohol used for religious or medical purposes.

This tax shall be computed from the total liquor and alcoholic beverages sales at the close of business on the last day of each month, and the tax value shall be paid into the Island Treasury during the first week of the month following that for which tax is levied.

3. Credit sales by merchants legally engaged in business become bona fide sales upon delivery of goods or merchandise to responsible purchasers, not minors, and on and after May 1, 1914, indebtedness to the full value of such goods or merchandise are recoverable in the Courts of the Island in the same manner as is now provided by law for the collection of all just indebtedness.

4. The following tax is hereby levied on all alcoholic beverages and liquors not manufactured in this Island of Guam in addition to any and all taxes now levied, to wit:

Containing not over 6 percent of alcohol, 1 cent

Containing not over 10 percent of alcohol, 2 cent

Containing not over 15 percent of alcohol, 3 cent

Containing not over 20 percent of alcohol, 5 cent

Containing not over 55 percent of alcohol, 10 cent

Containing more than 55 percent of alcohol, 20 cent

This tax shall be paid into the Island Treasury at the time of entry of the merchandise at the Custom House, or as soon thereafter as practicable for a verification of the bill of landing in each case and before withdrawal of said merchandise from the Custom House.

This levy becomes effective on and after May 1, 1914.

W. J. MAXWELL, USN

Governor of Guam

No. 181

16 May 1914

Executive General Order No. 181

It is hereby ordered and decreed that: –

1. All persons at present occupying lands to which they cannot show title either in fee simple or by lease are hereby called upon to take the necessary steps to establish their right to own or occupy such lands.

2. Authority to occupy public lands must hereafter be obtained from the Government.

3. All persons at present occupying public lands without proved title who make improvements on such lands after the date of this Order will do so without right to claim reimbursement.

4. This Order shall take effect from May 20, 1914.

W. J. MAXWELL, USN

Governor of Guam

No. 182

16 May 1914

Executive General Order No. 182

1. It is hereby ordered and decreed that: –

The Guam Government Service Pension Foundation is hereby established.

2. A Governing Committee consisting of

The Governor

The Treasurer

The Auditor

The Chief Clerk to the Governor

The Chief Clerk to the Island

will administer the affairs of the Foundation and be accountable for the Pension Fund hereby created.

3. The Governing Committee is authorized to invest or loan the moneys of the Pension Service Fund for the sole benefit of the members of the Foundation, such benefit to accrue only to members of good standing who resign or retire or to the next of kin of members who die in service in good standing.

4. All persons receiving regular stipends from the Naval Government of Guam and carried on its pay rolls are eligible to membership of the Foundation and become members upon appointment to the effect from the Governor.

5. The Fund will be created by credits earned by employees of the Government of Guam as follows: ––

Beginning May 1, 1914, all new island appointments to salaried or paid positions, except the Police Force, will carry a ten per cent credit of the “Base Pay” per month or per diem, as the case may be, for each five year period after date of first credit or for each past five year period of long and faithful service for which credit may be authorized to the Fund. The Police will be eligible to credits after eighteen (18) months continuous probationary service. The sum so credited will be considered as earned and payable to the members whose pay was used for the credit, but payment will be deferred until the resignation, retirement or death of such member. If at the time of such resignation, retirement or death the member is in good standing there will be paid also the prorate share of earnings of the Fund, otherwise not.

6. Membership may be continued either by a retired or resigned member or, in case of death of a member, by his next of kin if desired; and all benefits derived from investments will be prorated so long as the earned credits derived from any salary remain in the Fund.

7. Payment to beneficiaries will be made at a any time after becoming due ON DEMAND.

8. Members of the Foundation may borrow at six per cent per annum or one half of one per cent per month up to the amount of their credit in the Fund at the time of the loan.

9. The Governing Committee may make loans to private parties on good security, not to exceed $100.00 each, at any month. Loans are repayable monthly, in whole or by installments, and interest on a loan will be computed and charged monthly.

10. The Treasurer will credit the Fund as ordered by the Governor and will pay sums on Treasury Warrants signed by the Chief Clerk to the Island and approved by the Governor.

11. The Governing Committee will make its own By-Laws but all measures must be unanimously adopted.

12. This Order shall take effect as from May 1, 1914.

W. J. MAXWELL

Governor of Guam

No. 183

10 June 1914

Executive General Order No. 183

It is hereby ordered and decreed that: –

1. A Bureau of Industry, under the direction of the Department of Public Works, is hereby created.

2. The Bureau will be administered by

A Superintendent,

A Supervisor of Animal Industry and such Experts, Inspectors, and other Assistants as from time to time may be necessary for the service of the Bureau in its various subdivisions.

3. The Bureau of Industry shall administer such Public Utilities as may be under the control or direction of the Department of Public Works.

4. On and after July 1, 1914, the Meat Market, the Abattoir, the butchery of live stock, and placing on public sale of butchery of live stock, and placing on public sale of butchered meat will be placed in charge of the Supervisor of Animal Industry as a public utility under the provisions of this Order.

W. J. MAXWELL, USN

Governor of Guam

No. 184

20 June 1914

Executive General Order No. 184

It is hereby ordered and decreed:

1. That the manufacture, sale or disposal for profit, in any way, of any intoxicating spirituous liquors is hereby prohibited, except under a license, or permit, issued by the Governor or by his order. Any person who violates or knowingly assists in a violation of the provisions of this paragraph (1) shall, upon conviction, be punished as set forth in paragraphs 9, 11, 16, 17, 18, 19, 20, 21, 23, 26, 27, 28, 30, 31, 32, 33, 34, 35, and 36 of this law.

2. The Island Court shall have jurisdiction over offenses under this order not otherwise provided for.

3. There are hereby established Liquor Licenses to be issued at the discretion of the governor to all persons or corporations who traffic in spirituous liquors.

4. DEFINITIONS: “Spirituous liquors” shall mean any wines, spirits, ale, cider, beer, or other fermented or distilled liquors, and all liquors of an intoxicating nature. “Sunday” shall mean the time between ten-thirty (10:30) of the clock on the evening of Saturday, and six (6:00) of the clock on the morning of the succeeding Monday.

5. LICENSES: Signing; term; not transferable. The licenses issued under this order shall be signed by the governor and sealed with the Executive seal, and shall not be transferable. They shall be in force for one fiscal year or for a part of a fiscal year if the license is granted between the first of July of one year and the thirtieth of June of the following year, provided that; for the purpose of placing this law into effect on July 1, 1914, the fee received for any license issued, shall be prorated and the balance rebated and paid from the Treasury to all persons holding liquor licenses issued between January 1, 1914, and prominently posted on the licensed premises.

6. RECORD OF LICENSES: A record of all licenses granted to vendors of spirituous liquors shall be kept in the Executive Office, showing the name of the licensee; the date and character of the license; the fee paid therefor; the street and place where the business is to be conducted. All applications for such licenses shall be in writing, and shall contain informations required by this paragraph.

7. Licenses for the sale of liquor shall be denominated as wholesale, retail, or for distillation and manufacture, according to the purpose for which issued.

WHOLESALE LICENSES

8. APPLICATION: The Governor may grant a wholesale vending license for spirituous liquors to any person applying therefor in writing, and stating in his application the name of the vendor and where the applicant intends to establish his place of business.

9. A holder of a wholesale license is authorized to import spirituous liquors, and may sell the same upon the presentation of a permit signed by the Governor or by his order, specifying the quality and quantity (not less than the packages originally-imported) of the liquor authorized to be purchased. Provided, that neither the same, or any part thereof, be drunk or used on the premises where it is sold, or in any other house or premises contiguous thereto, rented or procured for the purpose by the holder of the license, or by any other person or persons, whatsoever, acting as his agent or representative. A violation of any of the provisions of this paragraph (9) shall be punished by a fine of five hundred dollars ($500.00), and the forfeiture of the license.

10. The persons to whom the permit to buy spirituous liquors is granted must, in every instance, certify on the back thereof to the receipt of the articles purchased.

11. The holder of such license shall retain all permits presented to him on which sales have been made, and return the same to the Executive Office on the last day of each week, with a certified statement that no liquors have been sold, or otherwise disposed of, to any person or persons, whomsoever, other than those for which said permits have been issued. He shall also submit to the Executive Office, on the first day of each month, a certified statement showing in detail:

(a) The amount of liquors on hand on the first day of the month just ended.

(b) The amount received.

(c) The amount of liquors sold during the month.

A violation of the provisions of this paragraph (11) shall subject the holder of the license to an Executive fine of not more than ton dollars ($10.00).

12. FEE: The fee for a wholesale license shall be one hundred dollars ($100.00) per fiscal year.

RETAIL LICENSES

13. APPLICATIONS: The Governor may grant licenses to retail spirituous liquors, upon application in writing, stating the name of the vendor and where the applicant intends to establish his place of business in each district.

14. WHAT LICENSE COVERS: Such last mentioned license shall authorized the licensee to import, sell, and dispose of any spirituous liquors, by glass or bottle, to be drunk on or off the premises so licensed on every day, except Sunday, between the hours of 6:00 a.m. and 10:30 p.m. and at no other times.

15. FEE: The fee for a retail license shall be five hundred dollars ($500.00) per fiscal year.

16. TERMS OF LICENSE; PENALTY: The sale and vending of spirituous liquors shall be regulated as to the time, place, quantity, and manner in which the licensee is by such license authorized to sell and dispose of such liquors, by the terms of the license consistent with this law, and any person who shall sell, or cause to be sold, any spirituous liquors, except as regulated by this license or by law, shall, for the first offense, be fined one hundred dollars, ($100.00), and for the second offense, two hundred dollars, ($200.00), with forfeiture of his license.

17. SUNDAY SALES PROHIBITED. Any holder of a retail license under this law who sells or retails any spirituous liquor, or who permits or suffers the same to be drunk in his house or premises on Sunday, except with meals served and consumed in good faith, shall be fined one hundred dollars ($100.00), and for the second offense, be fined two hundred dollars ($200.00) and forfeit his license.

18. MINORS AND FEMALE PERSONS. Any person holding a retail license under this law who employs, in or about the room where intoxicating or spirituous liquors are sold, or dispensed to be drunk on the premises, any minor, or nay female person, shall be punished by a fine or not less twenty-five dollars ($25.00), nor more than one hundred dollars ($100.00), and for the second offense by a similar fine and the forfeiture and revocation of his license.

19. SALE TO MINORS. Any person who knowingly sells to a minor any intoxicating liquor, or who allows or permits any minor or female person to visit, or remain in the room where such liquors are sold, kept for sale, or dispensed, as provided for in a retail license, shall be punished by a fine of not less then twenty-five dollars ($25.00), nor more than one hundred Dollars ($100.00).

The restrictions in paragraph 18 and 19 as to female persons, shall not be held to apply to the lawful wife off a licensee, supervising the business in the temporary absence of the husband from the Island, or during the unexpired term of the license after his death or after his departure from Guam.

20. SALES TO INTOXICATED PERSONS: Any person holding a retail license under this law who, either on his premises, or in any of the attachments or annexes thereof, supplies any spirituous liquor to any persons then in a state of intoxication, shall be punished by a fine of not more than one hundred ($100.00). And if any such intoxicated person remains more than three hours on such premises, the holder of the license shall, in each case, be liable to the same penalty.

21. INTOXICATED PERSONS ON PREMISES: Every person who, being intoxicated, enters any premises, licensed for the sale of spirituous liquors or being intoxicated upon said premises, shall not leave the same when requested to do so by the licensee, or by any person in his employ; and any person not being either the licensee of the premises or an employee of said licensee, who, whether intoxicated or not, is found sleeping, or lying recumbent in said premises during prohibited hours, may be arrested by any police officer, and punished by a fine or ten dollars, ($10.00).

22. No retail license shall be granted for the sale of liquor within a radius of the five hundred (500) feet of any school, church, or public office; or within a radius of three hundred (300) feet of any residence, except upon the written consent of the owner, or occupant, of such residence: provided, that, such license having been duly granted, nothing in this paragraph shall be so construed as to prevent its continuance in force for the term specified in said license and provided further that unless the owner objecting can show cause of complaint, the licensee shall not be deprived of the right of renewal of license at his place of business. The Government will fix the districts in which the retail sale of spirituous liquors may be permitted.

23. DURING PROHIBITED HOURS AND SUNDAYS. Every person who is found drinking on any premises licensed under this law during prohibited hours, or on Sundays, shall be liable to the same penalty as that to which the licensee is subject for keeping open his licensed house at times not allowed by his license, and such persons may be arrested by any peace officer. The proprietor, or keeper, of any place where intoxicating liquors are sold, or dispensed, shall keep the windows of said place free from any shutter, blind, curtain, or screen of any kind which will tend to prevent a free and unobstructed view of the premises, its bar and appurtenances; and any owner, or proprietor, who offends against the provisions of this paragraph, is guilty of a misdemeanor, and upon conviction shall be punished by a fine of not less than twenty-five dollars ($25.00) nor more than one hundred dollars ($100.00) for each offense.

LICENSES FOR DISTILLATION

24. APPLICATION. The governor may grant licenses to distill alcohol and to manufacture spirituous liquors, upon application in writing, stating the name of the vendor and where the applicant intends to establish his place of business in each district.

25. FEE. Before the above license to distill alcohol and to manufacture spirituous liquors is granted, the applicant shall pay into the Island Treasury, the sum of two hundred dollars ($200.00) per fiscal year.

26. TERMS OF LICENSE; PENALTY. The holder of a license for distillation of alcohol and manufacture of spirituous liquors, will be authorized by the license to distill rum containing not less than 45% pure alcohol from sugar cane; to distill ethylic alcohol not below 90% pure; to manufacture gin containing from 40 to 60% of pure alcohol, and not over 5% of residue including sugar, from ethylic alcohol, juniper berries, fennel, aniseed, coriander and other aromatics, but such gin should be free from turpentine; to manufacture “aniseta” or “anisoda” from alcoholic extract of anise, using alcohol 85% pure, sugar and water; to sell or export the above manufactured or distilled rum, alcohol, gin, “aniseta” or “anisado” in wholesale lots of not less than nine litres. Any infraction of the provisions of this paragraph shall be punished with a fine not less than twenty dollars ($20.00), not exceeding two hundred dollars ($200.00); and if convicted twice within a period of twelve consecutive months, with the forfeiture of the license.

27. PREMISES TO BE IN PROPER CONDITION AND OPEN TO INSPECTION; PENALTY: The premises upon which alcohol is distilled and spirituous liquors manufactured, shall, at all times, be open for free inspection by the proper authority. The plant shall be maintained in a clean and sanitary condition. The entire process of distillation to go on within a locked enclosure to which none but employees of the licensee duly engaged in the work and inspectors of the Government shall be admitted; and from which locked enclosure none of the products are to be removed until they have been inspected an certified to by a duly authorized agent of the Government. Infractions of the provisions of this paragraph shall be punished with a fine, not less than fifty dollars nor more than five hundred dollars ($50.00 to %500.00) or forfeiture of license, or both.

28. REPORTS. The holder of the above mentioned license, shall report weekly the actual number of litres output of the plant during the preceding week and the amount in litres sold during the same week. A false statement in any reports regarding the business fro which the license is issued shall be punished with a fine not exceeding two hundred dollars ($200.00); and in case of being convicted twice of the same offense; with a fine of three hundred dollars ($300.00) or with the forfeiture of the license, or both.

29. AGUARDIENTE. The distillation or manufacture of the raw products known as “aguardiente” or “vino de tuba” or “nipa” is forbidden.

GENERAL PROVISIONS

30. SALE WITHOUT LICENSE. Any person, other than the holder of a license under this law, or his agent, or servant, who sells or disposes of any spirituous liquor within the Island, or who causes or authorizes to be sold therein any spirituous liquor by any person employed, hired, or engaged for such purpose without being thereto authorized by license as by this law provided, shall be punished, for the first offense, by a fine of one hundred dollars ($100.00), and for every subsequent offense, by a fine of not more than two hundred dollars ($200.00), and by imprisonment for not less than three nor more than six months. The provisions of paragraph 1, Executive General Order No. 98, shall not apply to offenders sentenced to imprisonment under this paragraph (30).

31. Any person who, without due license or permit from, or by authority of, the governor, manufacturers, distills, imports, sells, or disposes of, for gain, any intoxicating liquor, anywhere in the Island of Guam, shall, upon conviction, be punished by a fine of not less than two hundred dollars ($200.00) nor more than five hundred dollars ($500.00).

32. No article of beverage containing alcohol shall be sold, or exposed for sale, on permitted upon premises licensed under this law, except such as have been duly entered through the Custom House, or acquired by purchase from distilleries legally authorized. A violation of the provisions of this paragraph (32) shall be punished by a fine of not less than twenty-five dollars ($25.00) nor more than one hundred dollars ($100.00).

33. PREMISES OPEN TO INSPECTION. The premises upon which spirituous liquors are sold under the wholesale and retail licenses provided for in this Order, shall, at all times, be open to free inspection by the police officers; and the holder of such license, his servant or agent, who refuses to permit, or forcibly resists, such visit of inspection, shall be punished by a fine of not more than one hundred dollars, ($100.00) and for a second offense, by a similar fine with the forfeiture and revocation of his license.

34. AGUARDIENTE DE TUBE VINO DE TUBA AND NIPA. The sale, or giving, of the products, generally known as “Aguardiente de tuba” and “Vino de tuba” and “Nipa” to any member of the enlisted force of any nation, is forbidden, and any person who shall sell, or give, to any enlisted man of any nation while on this station, said “aguardiente” “vino de tuba” or “nipa” in any quantity, shall be punished by a fine of not more than twenty-five dollars ($25.00) for the first offense, and by imprisonment for not more than six month for each subsequent offense. The provisions of paragraph 1, Executive General Order No. 98, shall not apply to offenders sentenced to imprisonment under this paragraph (34).

The existence, upon premises which enlisted men of any nation are seen entering or leaving, or upon which such enlisted men are found, of any such “aguardiente”, “vino de tuba” or “nipa” shall be deemed full and sufficient evidence for the purpose of conviction, under the provisions of this article (34), of the owner or tenant of the premises.

35. ILLEGAL POSSESSION OF LIQUOR. Any person having in his possession a bottle, or other vessel containing “aguardiente”, “vino de tuba” or “nipa” and who shall not be able to show a permit to have in his possession and also to establish, to the satisfaction of the trail Court, the legal acquisition of said bottle or vessel containing said liquor, shall be liable to a fine of not more than five dollars ($5.00) for each infraction.

36. ADULTERATED LIQUOR–TUBA. Any person holding a license under this law who sells, or offers for sale or for consumption adulterated spirituous liquors, of any kind or in any quantity or the distilled liquor, usually known as “aguardiente”, “vino de tuba” or “nipa” shall be punished for every such offense by a fine of not less than twenty-five dollars ($25.00) nor more than one hundred dollars ($100.00) unless that action constitutes one of the crimes punished by the Penal Code: in which case the infractor of this provision shall be punished according to the provisions of the Penal Code.

37. The holder of a license issued under the provisions of this General Order shall be held responsible for any and all illegal acts done by his agent, servant, or employee in conducting the business for which his license is granted. The holders of any license under this law shall furnish the Chief of Police (Information Bureau) with the full names and other means of identification of all persons employed by them in connection with the liquor business.

38. The Court before which an offender against the provisions of this law, or any part thereof, is convicted, is empowered to declare contraband, and to confiscate, all articles of spirituous liquor or other articles used by the offender thus convicted in said violation of this law; and such contraband and confiscated articles shall, at the discretion of the Court and by its order, be delivered after condemnation, to the Executive authority, to be sold at public auction or for charitable purposes or the arts, or if unfit for use, to be destroyed.

39. TAXES. Holders of licenses under this law shall pay the taxes provided for by Executive General Order No. 180. those holding a retail license will be exempted from those taxes if they do not desire to exercise the right to import spirituous liquors. A statement in writing to this effect must be made by the licensee who may, also in writing, withdraw from this agreement thirty days after notice to the Government, when he will be subject to said taxes.

40. EXCEPTIONS. Clubs incorporated under the laws of Guam and other similar incorporated mutual associations, shall pay a license of fifty dollars ($50.00); but they will not be excepted from the taxes provided for by Executive General Order No. 180 when they import all or any part of the spirituous liquors in use or sold by them. The license authorizes them to import, and to sell spirituous liquors in any quantity only to members and those entitled to the privileges of the club or similar association, in accordance with the constitution and By-Laws. of the said Club or association, approved by the Governor. Any infraction of this last paragraph shall be punished with the same penalty provided for by paragraph 9 of this law.

41. General Orders Nos. 1, 2, 8, 32, and 63; and Executive General Orders 113, 126, 139, 148, 169, and paragraph 3 and paragraph 5 of Executive General Order No. 91, and paragraph 6 of Executive General Order No. 162, are hereby revoked.

21 This law shall take effect on and after July 1, 1914.

W. J. MAXWELL

Governor of Guam

No. 185

1 July 1914

Executive General Order No. 185

It is hereby ordered and decreed that: –

1. The following REGULATIONS GOVERNING THE ADMINISTRATION OF THE UTILITY OF FORESTS OF GUAM shall have the effect of law and that all persons violating said REGULATIONS shall be subject to the same pain and penalties as are now imposed by law for violations of the Laws relating to the Utility of Forest.

REGULATIONS GOVERNING THE ADMINISTRATION OF THE

UTILITY OF THE FORESTS OF GUAM

Cutting Government timber is prohibited without license.

2. (a) To those owning no timber land and no house the license to obtain timber for use in the construction of a house shall be free, provided that the house is to be built and occupied by the person obtaining the license.

(b) It shall also be free to those owning no timber land for obtaining timber for use in preparing the house in which the owner resides.

(c) Licenses shall be free to those desiring fish weir stakes or fire wood. The fire wood shall be in pieces not exceeding two meters in length and two decimeters in diameter; pieces for fish weir stakes shall not exceed six meters in length and two decimeters in diameter.

3. Requests to cut timber shall be made to the Governor in writing, and the applicant shall sate the NUMBER, KIND and DIMENSIONS of the pieces desired, WHERE SITUATED, when the cutting is to be done, and the USE to be made of the timber.

The Government will decide the necessity for the cutting in each instance and will fix the allowed quantity.

4. A license to cut timber shall be valid for six months after date of issue and no longer and said license shall be void unless cutting under same is begun within four months.

5. No timber shall be cut until the applicant for the license shall have satisfied the Insular Patrol (through the Commissioner or Municipal Clerk if desired) that he has planted, under proper growing conditions, at least double the number of trees of the same species that he desires to cut. The roots of all stumps of felled timber must also be prepared so as to make shoots grow.

6. The holder of a license for cutting timber must notify the Insular Patrol of the municipality (through the Commissioner or Municipal Clerk if desired) of the time and when and the place where cutting under such license will begin and of the place where the timber cut will be piled. No timber will be removed from such place until all cutting under the license is completed. When the cutting of timber under a license has been finished, the holder of the license will notify the Insular Patrol, who will mark the slumps measure and mark the timber, and endorse on the license the number of logs cut, with measurement of each, and the destination of the timber. If the timber is not to be removed to the saw mill, the Insular Patrol will forward the license to the Head of the Police Department.

7. When timber is removed to the Government Saw Mill for sawing, the Master Joiner will endorse on the license the number and dimensions of the logs sawed, identifying them by marks and by data entered on the license by the Insular Patrol. When sawing is completed the Master Joiner will forward the license to the Head of Police Department with a note to that effect entered thereon.

8. No Ifil, Dug-Dug, and Daog trees of less than twelve inches in diameter, and no Ajagao, Laña, Panao, Chosgo trees of less than eight inches in diameter shall be cut, and the height of the stump of any tree must not exceed the diameter at stump.

9. No other timber than that authorized to be cut will be used in removing logs from the forests. Particular care must be exercised in the removal of logs to avoid damage to young trees, especially Ifil, Ajgao and other timber used for construction purpose.

10. Whoever fells undersized trees, or a greater number of trees than that specified in the license, or fails to notify the proper officials; or cuts timber in areas not specified in the license, or does not exercise reasonable care to avoid the destruction of young trees in removing logs, or makes use of the timber for any purpose other than that specified in his license, shall be punished in accordance with the laws of the Island.

11. The use of the Say Mill for sawing timber may be granted when not to the prejudice of Government work. For this service, cost with a ten per cent over charge for wear and tear will be required, but payment may be made in kind at the rate of eight-tenths of a cubic foot of timber of the same species as that which is cut, delivered free at the Saw Mill or such other place as the government may direct, for every cubic foot which the applicant desires to be sawed.

W. J. MAXWELL

Governor of Guam

No. 186

13 July 1914

Executive General Order No. 186

It is hereby ordered and decreed that: –

1. Judges, officials of the military, administrative or financial departments of this Island and in general any public official, is hereby forbidden to engage directly or indirectly in exchange, trade, or gain transaction within the limits of the Island of Guam, with regard to objects not the product of their own property.

2. This provision is not applicable to those who invest their homes in the start of a bank or any enterprise of company, provided they do not hold therein any office or exercise any direct intervention, either administrative or financial.

3. For the purposes of this law, every person shall be considered a public official who, by the immediate provisions of law or by popular election or appointment by the Federal or Insular Government, takes part in the exercise of public function.

4. Contraventions or offenses against the provision of this General Order, shall be punished with the same penalty provided for by article 400 of the Penal Code in force in this Island.

5. This law shall take effect from and after the 15th day of July, 1914; provided: that for the purpose of this law all holders of traders licenses who come under the provisions of this law may transfer such licenses to a duly empowered agent whose name and address shall be reported to the Civil Registry, and the transfer will become effective when the license is countersigned by the Civil Registrar; and further provided that original holders of such traders licenses may continue to do business under their licenses until August 15th, 1914 and so that the provisions of this law shall take full effect on July 1st, 1915. Any law or part of any law inconsistent with this Order is hereby revoked.

W. J. MAXWELL

Governor of Guam

No. 186 Correction

15 July 1914

Correcting error in Executive General Order No. 186

In paragraph 2, second line, substitute the word “funds” for “homes” and substitute the word “stock” for “start”.

In paragraph 3, last line, make word function plural by adding letter “s”.

O.G. MURFIN

By Direction

No. 187

10 July 1914

Executive General Order No. 187

It is hereby ordered and decreed that:

1. PERSONAL TAX. There shall be imposed upon each male person of 18 to 60 years of age domiciled or residing in Guam, without distinction as to race or nationality, a personal tax of two dollars per year.

2. The said tax shall become due on the first day of July of each year and shall be payable into the Island Treasury on or before the first day of January of the following year; after the last named date it shall be deemed delinquent.

3. The Civil Registrar shall prepare and deliver to the Treasurer of the Island, before the first day of July of each year, a list of the names of all persons subject to the personal tax during the ensuing fiscal year.

4. The Island Treasurer shall, as soon after the first day of May as practicable, furnish the Auditor for the Island of Guam a list of names of all those whose personal tax for that year has become delinquent and said delinquency shall constitute a misdemeanor punishable according to article 574, paragraph 5, of the Penal Code.

5. Anyone who give notice before the first day of July of any year that he proposes to pay the personal tax by labor, shall be called to work for payment of the tax at the rate of fifty cents per day worked; and such person, after having given notice, must report for work when called for on three days notice, and upon failure to so report shall be prosecuted before the Island Court, and upon failure to show good cause shall be punished according to article 574, paragraph 5, of the penal Code.

6. Those who do not elect to pay the personal tax in labor, shall pay it in legal tender money of US; and upon failure to pay the personal tax on or ya yaguin ti ja-apase y comunidanñija gui primero de Enero pat antes, este na deilneuente tiene que umana multa un peso oro, pa yaguin ti ja-apase y multa yan y comunidaña antes de y primero de Febrero siguiente, tiene que uma aresta ya umajusga gui Corte (Island Court) por falta, ya yaguin probao na isao tiene que uma castiga parejoja yan ayo y ti prumesenta sija para man-machocho, segun y articulo 574, parafo 5.

7. Man ma exceptua gui apas comunida este sija na taotao: (a) ayo sija y umo-cucupa posicion oficial gui Gobierno y Isla pat y Gobiernon Estados Unidos; (b) todo y militar en activo servicio; (c) todo funcionario yan empleao y Gobiernon y Isla ni y ti manman resisibe recompensa por y servicion ñija, pat y apas ñija, por mes pat por año; (d) todo Gobernadoreillo, Teniente yan Juez de sementeras durante y sacan despues de man basta gui oficion ñija; (e) todo y man inutil para man mañoda salape por man malango tataotao ñija pat man armariao, ni y ja certifica y medico, pat ayo sija y man sen tai guinaja.

8. Ayo sija na taotao y mansineda gui jiniyong este na Orden General man delineuente, segun y jagas Orden General sija, tiene que uja-apase una multa de un peso oro; ya yaguin ti ja-apase y comunidanñija yan y multanñija gui primero de Marzo, tiene que ufan ma arresta ya ufan ma jusga gui Corte ya ufan ma castiga taimano y sinangan y articulo 5 yan 6 guine na Orden, yan segun y articulo 574, parafo 5, gui Codigo Penal.

9. Y Orden General No. 16, 38, 64 yan 72, yan y articulo 1, 2, 3 yan 4 gui Orden General Ejecutiva No. 90, yan y Orden General Ejecutiva No. 101, 117, 142 yan 170, man ma deroga, ti man vale.

10. Este na Orden General Ejecutiva vale yan gai sisiña como lai desde y 10 yan despues de y 10 de Julio de 1914.

W. J. MAXWELL

Magalajen Guam

No. 188

30 July 1914

Executive General Order No. 188

It is hereby ordered and decreed that: –

1. The following regulations governing the use of vehicles in the Island of Guam are hereby established.

2. No freight carrying vehicles having tires less than two inches in width shall use the improved public roads and highways of the Island. Improved public roads and highways are those roads on which the Federal or Insular government has expended funds in construction or repairs. On and after July 1, 1915, no freight carrying vehicles having tires less than 2½ inches in width shall use the improved public roads and highways. Violations of the provisions of this paragraph shall be punished by a fine of $3.00 for each offense, such fine to be imposed and collected by the Executive Office.

3. All vehicles using the improved public roads and highways of the Island will be subject to an annual tax, to be paid by the owners thereof, as follows:

| Automobiles (including trucks) | $10.00 |

| Motorcycles | $3.00 |

| Carriages and wagonnettes | $1.00 |

| Wagons | $1.00 |

| Bull carts | $1.00 |

| Bicycles | $0.50 |

4. All carriages, wagons, wagonnettes, carts, motor and other vehicles of two seats or more, plying for hire, and used for the conveyance of persons, shall be licensed, the license fees to be paid annually by the owners thereof, as follows:

| Automobiles | $15.00 |

| Motorcycles | $5.00 |

| Carriages and wagonnettes | $8.00 |

| Wagons and carts | $2.00 |

5. All vehicles used for carrying merchandise for hire shall be licensed, the license fees to be paid annually by the owners thereof, as follows:

| Motor trucks | $10.00 |

| Wagons | $6.00 |

| Carts | $4.00 |

6. No person shall be permitted to pilot a motor vehicle until he has first obtained an annual license. The fees for such license shall be as follows:

| Automobile pilot | $2.00 |

| Motorcycle pilot | $1.00 |

7. A Pilot’s license will not be issued until the applicant has satisfied the Head of the Police Department that he is familiar with the traffic regulations and the laws of the Island governing motor vehicles, and that he can properly control his machine.

8. All vehicles owned by the Federal and Insular governments and the drivers thereof shall be exempt from the payment of the taxes and license fees provided for herein. All vehicles owned by officers and officials of the Federal and Insular governments and the drivers thereof shall also be exempt from the payment of taxes and license fees, provided that such vehicles are used and driven in the execution of government business. Officers and Officials must apply for the proper licenses when, upon approval by the Governor or by his direction, this license shall be free to the owner of the vehicle.

9. Vehicle and Pilot licenses will be issued by the Executive Office and numbers assigned to vehicles. Vehicle tags, having the license number, will be supplied by the Department of Public Works. The tags will be secured to the vehicle in such manner as to be clearly visible. All four wheeled motor vehicles shall have a number tag displayed on both front and rear.

10. Any person violating the provisions of paragraph, 3, 4, 5, and 6, shall for the first offense, be subject to a fine not to exceed double the amount of the tax which applies, and for the second offense to a fine not to exceed double the amount of the tax which applies and with forfeiture of his license. Said fines shall be imposed and collected by the Executive Office.

11. TRAFFIC REGULATIONS: ––The speed of any vehicle shall not exceed twenty-five miles per hour.

At curves and corners, where the road cannot be seen more than 100 meters in advance, speed of automobiles and horse vehicles will be reduced to ten miles per hour, and that of motorcycles and bicycles to fifteen miles per hour. Where the road cannot be seen more than twenty-five meters in advance, all vehicles shall slow to the slowest speed.

12. Within the limits of the town of Agaña the speed of vehicles shall not exceed fifteen miles per hour.

13. Every vehicle on public road or highway shall carry a suitable light or lights during the hours of darkness. All motor vehicles when moving shall carry a headlight, or headlights, of sufficient power to project the light on the ground not less than 100 meters in advance of the vehicle. All four-wheeled motor vehicles shall carry the usual rear automobile light in such manner as to clearly illuminate the rear number tag.

14. Any person violating these traffic regulations shall, for the first offense, be subject to a fine not to exceed $5.00, and for the second offense to a fine not to exceed $20.00 with the forfeiture of the license if such is held by the offender. Said fines shall be imposed and collected by the Executive Office.

15. General Orders Nos. 103, 122, 127; paragraphs 3, 4, 5, 7 and 8 of General Order No. 145; and subparagraphs 2, 3 and 4 of paragraph 1 of General Order 173, are hereby revoked.

16. This law shall take effect on and after August 1, 1914.

W. J. MAXWELL

Governor of Guam

No. 189

21 October 1914

Executive General Order No. 189

It is hereby ordered and decreed that: –

1. Any person who provokes a quarrel by word, gesture, look threat, or menace is “Ipso Facto” guilty of a misdemeanor, which, upon conviction in the courts of the Island of Guam, shall be punished by a fine of not less than twenty-five ($25.00) dollars, US Currency, and imprisonment of not less than ten (10) days.

2. In all cases of assault arising from quarrels or disturbances between persons, the burden of proof against the claim of self defense shall rest with the provoker of the quarrel or the disturbance as the case may be; and in cases where bodily injury is sustained by the provoker of a quarrel, the person so injured shall be debarred from judgment for damages in his favor.

3. No complaint for misdemeanor against any person will be entertained by the Prosecuting Officers of the US Naval Government of Guam until the case has been referred to the Police Department for investigation and report.

4. In cases where bodily injuries have been received or claimed, the accuser will be detained until the accused can be arrested by the police in accordance with EGO No. 158 and the complaint investigated in conformity with paragraph 3 of this order.

5. The Island Attorney or a legally appointed Deputy shall be present at the Police investigations required by the law and for this purpose will be subject to the call of the Chief of Police at any hour.

6. This Order shall take effect on and from the twenty-third day of October 1914. Those parts of any law which conflict with the provisions of this Order and hereby revoked.

W. J. MAXWELL

Governor of Guam

No. 190

21 October 1914

Executive General Order No. 190

It is hereby ordered and decreed that: –

1. The Department of Law of the US Naval Government of Guam is hereby created.

2. The Department of Law will be administered by the Attorney General of Guam who shall be a Commissioned Officer of the US Naval Service and shall be “Ex Officio” Provost Marshal Judge of the Island of Guam

3. The Provost Marshal Judge shall have the powers of a Judge of the Island Court as provided by EGO No. 158 and shall be the Trial Judge in all cases of concurrent Jurisdiction tried under the provisions of EGO 75.

4. The Department of Law has cognizance of all matters pertaining to Public Prosecution with which the Island Attorney has heretofore been charged; and for this purpose the Island Attorney, Deputy Island Attorneys, and all attaches of the Island Attorney’s Office will form the Prosecution Division of the Department of Law and are hereby made subject to the Attorney General.

5. The Attorney General and Provost Marshal Judge of Guam shall make such rules and regulations for the conduct of his Department as will enable him to comply with the Instructions for the Military Commander of the Island of Guam by the President of the United States under date of January 12, 1898. Such rules and regulations shall become effective upon approval by the Governor.

6. This order shall take effect on and from the twenty-third day of October, 1914. Those parts of any law which conflict with the provisions of this order are hereby revoked.

W. J. MAXWELL

Governor of Guam

No. 191

12 July 1915

Executive General Order No. 191

It is hereby ordered and decreed that: –

1. Executive General Orders No. 69 and 89 shall not be so construed as to prevent the agents of the Government from appealing in any case, civil or criminal, to which it may be a party; and such right shall not be denied to the Government.

2. This order shall take effect on and from this date. Those parts of any law which conflict with the provisions of this order are hereby revoked.

W. J. MAXWELL

Governor of Guam

No. 192

30 November 1915

Executive General Order No. 192

It is hereby ordered and decreed that: –

1. On and after January 1, 1916, a tax upon personal property of the inhabitants of Guam shall be levied, assessed, collected and paid into the Treasury of Guam in the manner and form hereinafter prescribed; and the purpose of such appraisement and taxation and collection, personal property in Guam shall be classed and taxed as follows; provided that the total amount of tax collected on any article for any one fiscal year shall not exceed 2½% of the appraised value of such article for that year:

Class I – Automobiles, motorcycles, motor trucks and all privately owned power propelled vehicles of every description of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-20 of 1%.

Class II – Motor boats, motor launches and all privately owned power propelled vessels of every description owned and operated by citizens of the United States or persons owing allegiance to and subjects of the United States or owned or acquired and operated by aliens prior to January 1, 1916, of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-20 of 1%; provided that no privately owned vessel of any character shall be allowed to engage as common carrier in the coastwise trade of Guam without a permit duly signed by the Governor of by his order.

Class III – Motor boats, motor launches and all privately owned power propelled vessels and vessels of every character and description owned and operated by aliens to the United States imported into Guam on and after January 1, 1916, of a value of $1,000.00 or less shall be taxed a the rate of 2% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-10 of 1%; provided that no vessel of any description owned wholly or in part by aliens shall be permitted to engage as a common carrier between any points or places of Guam.

Class IV – All power driven machinery of every description not named or placed within Classes I, II, and II of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-20 of 1%.

Class V – All precious stones and jewelry and articles of adornment which are manufactured or consist in whole of in part of gold, silver or other precious metals or of precious stones, which shall be imported into Guam on and after January 1, 1916, when of a value of $1,000.00 or less shall be taxed at the rate of 1% of the appraised value and for each $100.00 value in excess of $1,000.00 the rate of taxation shall be increased 1-10 of 1%; provided that this provision shall not apply to any article owned and worn or used as the official insignia of any office or person.

2. Additions to the items in any class or changes in the classification of any item of personal property, including those items hereby made taxable shall, when necessary or required, be made by Executive Notice and the tax due to any such change shall be payable on April first next after date of issue of the Executive Notice placing such article or articles on the lists heretofore mentioned; and all such articles or classes of personal property as may be hereafter so added to those classified by this order shall be subject to the provisions of this law in the same manner as if those items had been originally included in and classified by this order.

3. For purposes of appraisal and appeal for such appraisal, Executive General Order No. 56, is hereby made applicable to taxable personal property.

4. The personal property tax imposed by this law shall be payable at Agaña on and after the first day of April of each fiscal year: but in every other respect the provisions of Executive General Order No. 114; now providing for the payment and collection of real estate taxes, are hereby made applicable to the payment and collection of the personal property tax now or hereafter imposed by this law.

5. All articles of personal property mentioned in this order of which may hereafter come under its provisions which are owned by officers or officials of the United States Government or by those of the Naval government of Guam are exempted from the payment of the tax imposed by this law if such articles of personal property and habitually used by them in the execution of their Governmental business.

6. The tax imposed by this law shall not be collected against any article of personal property of any licensed trader of Guam which is carried in his stock in trade, when such article is kept and held unused and has been acquired solely for sale to bona fide customer, but such articles which are used by any merchant or trader in the prosecution of this business or for his own private use or benefit shall be subject to the tax; provided that the word “unused” shall not be construed to prevent the operation of any article necessary to maintenance of good working order or for demonstration or such article to prospective buyer.

7. The tax imposed by this law shall not be collected upon any property owned and used by any charitable or religious organization or association or by any of the members and associates of such organization or association if such article or articles or personal property are required or intended wholly for use of or for the charitable or religious purposes for which such association or organization is duly founded, authorized or associated.

8. All laws and parts of laws inconsistent with the provisions of this order are hereby repealed.

W. J. MAXWELL

Governor of Guam

No. 193

14 December 1915

Executive General Order No. 193

It is hereby ordered and decreed that:

1. There is hereby created and established in the Treasury of the Naval Government of Guam a Division which shall be known as the Bank of Guam; which shall be a depository for the purpose of conducting the fiscal business of the Naval Government of Guam in accordance with paragraph 23 of Rules and Instructions relative to the Accounting System of the Naval Government of Guam by the United States in the Island of Guam and for such other banking business as may now or hereafter be authorized by law.

2. The Bank of Guam is authorized:

(a) To buy and sell drafts and deal in exchange in United States and Foreign currency.

(b) To receive money on deposit subject to acceptance by the Bank and to use such sums and deposits for purposes of loan and exchange for the mutual benefit of the bank and each of its several depositors.

(c) To make loans, not exceeding 75% of such deposits, of the money deposited under such rules as may be made by the Board of Managers and approved by the Chairman.

(d) To execute deeds of trust.

(e) To execute chattel mortgages upon ships and their cargoes or both.

(f) To perform all necessary acts to secure and safeguard loans.

(g) Provided, however, that no lean shall exceed 50% of the taxed value of land, nor more than 50% of the selling value of a ship or cargo or both.

3. The Bank of Guam will opened for the conduct of business with the public at 10:00 a.m., on January 3, 1916, and its business will be continued thereafter on each day of the calendar year, Sundays and legal holidays excepted. The Bank will be open to the public during the established hours of official business.

4. The Bank of Guam is authorized to open accounts with acceptable depositors and to receive deposits in sums of not less than five dollars ($5.00). The deposits will be classed as follows:

Deposits on which no interest will be paid and which will be subject to withdrawal by depositors at any time.

Deposits, withdrawals from which will be subject to 20 days notice, upon which interest at the rate of not more than 2% per annum shall be paid. Interest on such deposits shall be computed on monthly balances on the 1st day of each calendar month and credited to the depositor’s account. Accrued interest will be compounded annually on the first day of each fiscal year.

5. Certificates of Deposits for each sum of one hundred ($100.00) shall be issued to depositors whose deposits amount to one hundred dollars or more. The sum represented by each of these Certificates shall share in the annual net profits of the Bank. Fifty per cent of the annual net profits of the Bank of Guam shall be transferred to the Reserve Account of the Treasury of the Navel Government of Guam and the other 50% shall be prorated among all the Certificates of Deposit and the value of the amounts so prorated shall be credited to the accounts of the holders of the Certificates of record on the last day of each fiscal year.

6. The management of the Bank of Guam is vested in a Board of Managers composed of the Governor of Guam, who is ex-officio Chairman of the Board of Managers, the Pay Officer of the US Naval Station, Guam, who is ex-officio the Comptroller of the Bank, the Auditor for Guam, the Treasurer of the Naval Government of Guam and one holder of record of a Certificate of Deposit, as a representative of the depositors. This representative shall be elected by the holders of Certificates of Deposit, each holder casting one vote, a majority of votes being necessary for election. The meeting for the election of the representative of the depositors shall be held annually on the last Wednesday in June of each year and the depositor so elected shall assume the duties of his office on the succeeding first day in July and shall hold office for one year or until his successor shall have been elected and shall have qualified; provided, that the first representative of the depositors shall be appointed by the Governor of Guam to hold office until the election of a successor at the first election as herein provided for.

7. The Treasurer of the Naval Government of Guam shall act as the Cashier of the Bank of Guam and shall keep all accounts and records of the Bank of Guam separate and distinct from the other records and accounts of the Treasury. The accounts of the bank shall be audited by the Auditor for Guam, in accordance with the Rules and Instructions relative tot he Accounting System of the Naval Government of Guam by the United States in the Island of Guam.

8. All laws and parts of laws inconsistent with the provisions of this Order are hereby repealed.

W. J. MAXWELL

Governor of Guam

No. 194

13 January 1916

Executive General Order No. 194

It is hereby ordered and decreed that:

1. The following REGULATIONS GOVERNING THE SANITATION OF THE ISLAND OF GUAM shall have the effect of law and all persons violating said REGULATIONS shall be subject to the pains and penalties now provided by law for “INFRACTION OF THE LAW”; or to an executive fine of not less than one dollar ($1.00) or more than five dollars ($5.00) US Currency; or to both.

2. Changes or additions to the following REGULATIONS will be made and published as required and will have the effect of law thirty (30) days after the approval of the Governor.

REGULATIONS GOVERNING THE SANITATION OF

THE ISLAND OF GUAM

1. Dwelling houses, which are not equipped with regular sanitary water closets, will be kept furnished with an out house for exclusive use as privy, and no other place on the premises will be used for such purpose. To prevent offensive odors, all deposits must be immediately covered with earth from a box of loose earth kept conveniently near for this purpose. The excreta receptacle must be covered when not in use.

2. All privy receptacles within the boundaries of urban districts will be emptied at least twice a week at the places and times designated by the Department of Health and Charities. In suburban and rural districts, owners or occupants of dwellings will maintain pits not less than four feet deep, into which the contents of receptacles will be emptied and the contents covered with dirt. When a pit is filled to within a foot of the top, it will completely filled and a new pit dug.

3. The legal occupant of every dwelling house, store, storehouse and of all other buildings will provide the premises with one or more receptacles for garbage, sufficient in capacity to contain all garbage accumulating on said premises within the period of forty eight (48) hours. Garbage receptacles should be made of wood or metal and should be kept covered with a removable cover and so secured as not to permit of being overturned. All such receptacles, for convenience in removing contents, must be kept within the premises and near, but not on the streets.

4. Garbage receptacles for premises within the boundaries of towns will be emptied at such times and places as the Department of Health and charities may designate. In the rural districts, occupants of dwellings will burn all their garbage and bury tin cans in the pits provided for excreta.

5. Every occupant of a dwelling, and the owner of tenant of an unoccupied dwelling, a store, storehouse and of all other building will keep the buildings and grounds in a sanitary condition, free from all garbage and filth of any kind, and will keep all weeds and grass on their premises cut to a length not exceeding six (6) inches.

6. The provisions of this order will take effect on July 1, 1916.

W. J. MAXWELL

Governor of Guam

To go back to the list of General Orders click here.